The short call option strategy is a bearish options trading strategy with a limited profit potential with theoretical unlimited loss. Suited for neutral to bearish outlook. Suitable for experienced traders with approval for highest level of options trading

Trade

-Sell 1 call option

Note: like most options strategies, calls can be purchased in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM).

Preference : Sell an 16-20 delta OTM call

Trade Example

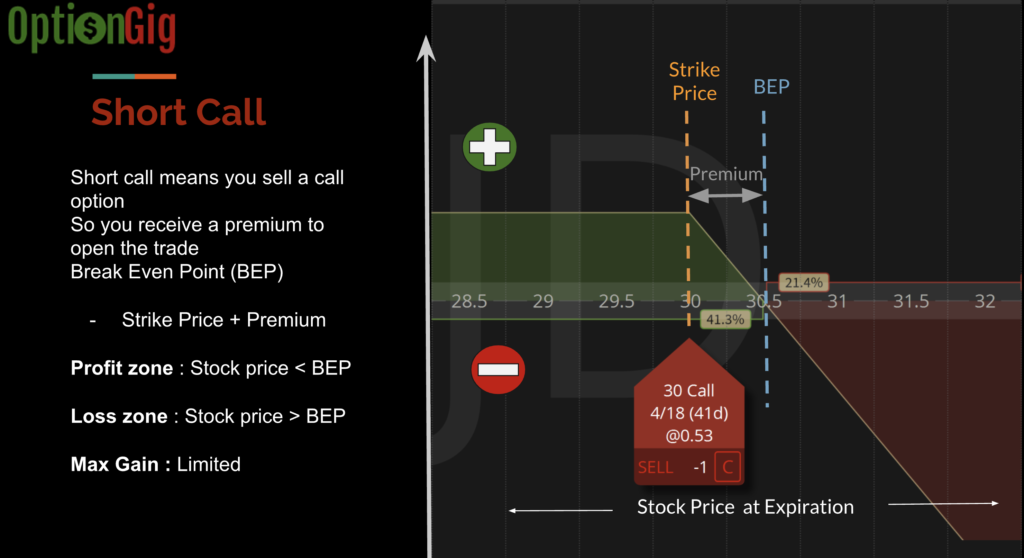

-Stock XYZ is trading at $28 a share.

-Sell 30 call for $0.53

Profit and Loss Diagram

Short Call Summary

| Break Even Price | Strike Price + Premium Received |

| Maximum Profit | Limited to initial premium received |

|---|---|

| Maximum Profit Scenario | Stock stays at below the strike price |

| Maximum Loss | Unknown |

| Maximum Loss Scenario | Stock goes higher than Breakeven Price |

| Why Trade | If you are bearish on a stock you can use this option strategy. |

| When to Trade | Stock Assumption : Bearish Volatility : When volatility is high, so you gather more premium to open the trade |

| When to Close | When the trade is making 50% of max possible profit |

| Legs | 1 leg |

| Passage of time | Positive. With passage of time, the value of this option decreases which is positive for your portfolio |

| Increase in volatility | Negative. With increase in volatility, the value of option increases. |