The long put option strategy is a bearish options trading strategy that act with limited outgo and windfall gains if stock moves a large move downwards. In this you buy a right to put a stock at the strike price. Will benefit if stock moves sharply lower than the strike price

Trade

-Buy 1 put option

Trade Example

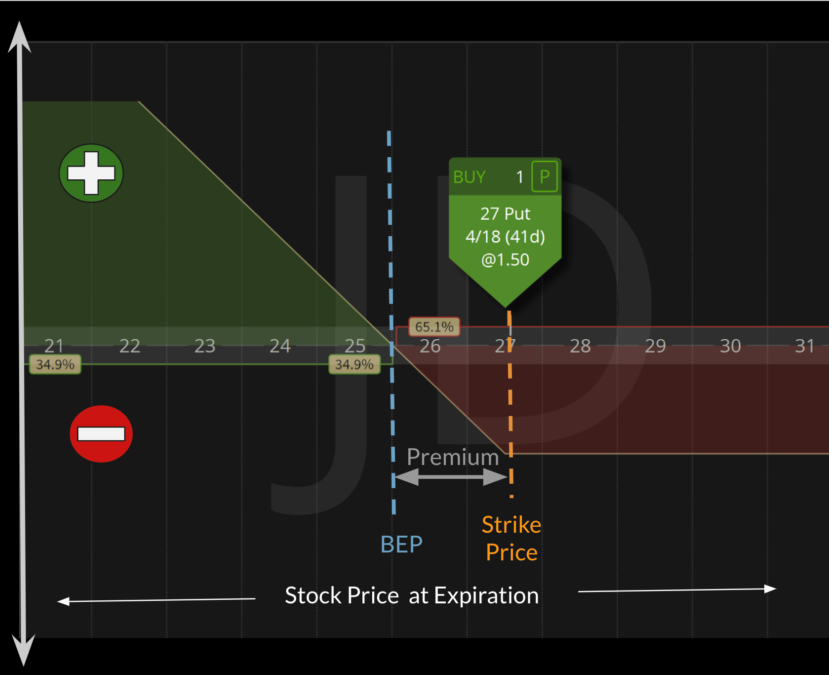

-Stock XYZ is trading at $28 a share.

-Buy 27 put for $1.50

Profit and Loss Diagram

Long Put Summary

| Break Even Price | Strike Price – Premium Paid |

| Maximum Profit |

Strike Price of Stock *100 – Initial premium paid |

|---|---|

| Maximum Profit Scenario | Iff stock goes to $0.00 before expiration |

| Maximum Loss |

Limited to initial premium paid |

| Maximum Loss Scenario | Stock stays higher than the strike price |

| Why Trade | If you want to protect and existing investment in stock, then you can buy a put option as an insurance against stock going down and portfolio incurring losses. Before you jump to buy puts, remember that premium you pay is based on theoretical value of stock decreasing |

| When to Trade | Stock Assumption : Very Bearish Volatility : When volatility is low, so you pay less premium to enter the trade |

| When to Close | There is no set profit target. |

| Legs | 1 leg |

| Passage of time | Negative. With passage of time, the value of this option decreases. You had bought the option to open the trade and would want the option to rise |

| Increase in volatility | Positive. With increase in volatility, the value of option increases |