The call credit spread is a bearish options trading strategy with pre-defined maximum loss . It is comprised of a short call and a long call, and is sometimes also referred to as a “bear call spread” or “short call spread”

Trade

-Sell 1 call

-Buy 1 call at any price higher than short call

Trade Example

Stock XYZ is trading at $27 a share.

– Sell 28 call for $1.12

– Buy 30 call for $0.54

– The net credit received for this trade is $0.58

Width of Spread : $30-$28 = $2

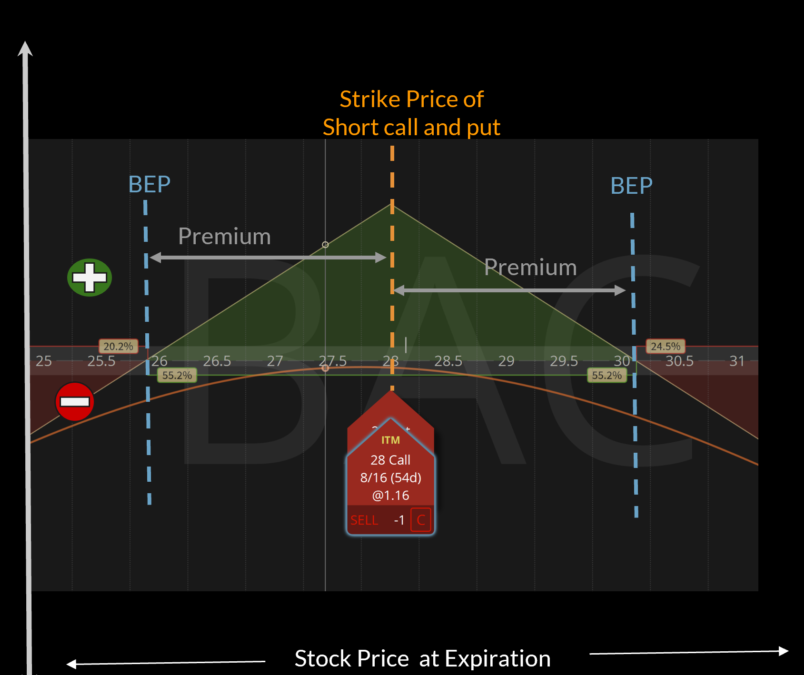

Profit & Loss Diagram

Call Credit Spread Summary

| Break Even Price | Strike price of short leg + Premium |

| Maximum Profit | Limited |

|---|---|

| Maximum Profit Scenario | Stock is at or lower than the strike price of the short call leg |

| Maximum Loss | Limited : Width of spread – Initial Premium |

| Maximum Loss Scenario | Stock is higher than the strike price of long call leg |

| Why Trade | It caps the maximum loss It uses less buying power as compared to short call |

| When to Open | Stock Outlook : Neutral to moderately bearish Volatility : High so you can get higher net credit |

| When to Close | When the trade is making 50% of the max profit potential |

| Legs | 2 legs |

| Passage of time | Positive impact on trade. With passage of time, the value of this option decreases but at lesser rate when compared to just short call |

| Increase in volatility | Negative impact on trade. With increase in volatility, the value of option increases |