The long call option strategy is a bullish options trading strategy with a theoretical unlimited profit and a limited loss. Buying call options creates a long position on an underlying asset and limits net downside exposure.

Trade

-Buy 1 call option

Note: like most options strategies, calls can be purchased in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM).

Tip : If you want to buy calls, do not buy deep ITM or deep OTM call options. The bid/ask spread is too wide. Better is to buy ATM, slightly ITM or slightly OTM call

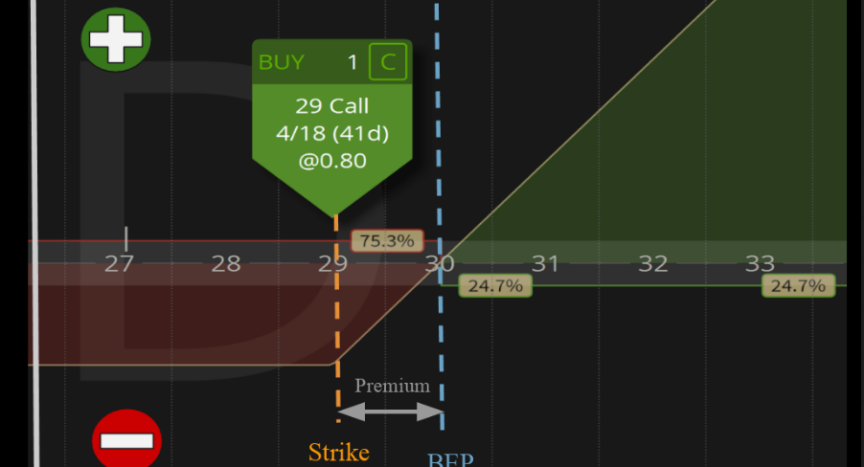

Trade Example

-Stock XYZ is trading at $28 a share.

-Buy 29 call for $0.80

Profit and Loss Diagram

Long Call Summary

| Break Even Price | Strike Price + Premium Paid |

| Maximum Profit |

Unlimited because stock can go to infinity, at least in theory |

|---|---|

| Maximum Profit Scenario | Stock rises meteorically beyond the break even price |

| Maximum Loss |

Limited to initial premium paid |

| Maximum Loss Scenario | Stock stays lower than break even price |

| Why Trade | If you want to get leveraged bullish exposure to a stock at lower investment as compared to owning the stock outright |

| When to Trade | Stock Assumption : Very Bullish Volatility : When volatility is low, so you pay less premium to enter the trade |

| When to Close | There is no set profit target. |

| Legs | 1 leg |

| Passage of time | Negative. With passage of time, the value of this option decreases |

| Increase in volatility | Positive. With increase in volatility, the value of option increases |